Let’s be honest. Managing the finances of a company where your team is scattered across time zones—or even continents—is a whole different ballgame. It’s not just about moving your old spreadsheet online. It’s a fundamental shift in how you think about cash flow, compliance, and even company culture.

Here’s the deal: the tools and tactics that worked in a centralized office can become serious liabilities in a distributed world. We need a new playbook. One that embraces flexibility without sacrificing control, and that turns geographical diversity from a logistical headache into a strategic advantage. Let’s dive in.

The Core Financial Challenges of a Distributed Model

First, you have to name the beasts you’re fighting. For remote-first companies, the financial hurdles are pretty consistent.

1. The Multi-Currency, Multi-Tax Maze

When you hire in Berlin, pay a contractor in Buenos Aires, and have a legal entity in Delaware, things get… complex. You’re juggling foreign exchange rates, international payroll regulations, and a patchwork of tax obligations. A simple mistake here isn’t just an accounting error—it can lead to serious penalties.

2. Visibility and Cash Flow in the Cloud

Without the ability to pop your head into the finance department, you lose a layer of intuitive understanding. Real-time visibility into spending becomes critical. Are those SaaS subscriptions still needed? How are project budgets holding up? Cash flow management for remote teams requires a single source of truth that everyone can access—but not everyone should edit.

3. The Trust & Accountability Equation

This is a big one. Micromanaging expenses from afar kills culture and productivity. But a total free-for-all is, well, financially reckless. The goal is to build a system rooted in clear policies and mutual trust. Easier said than done, right?

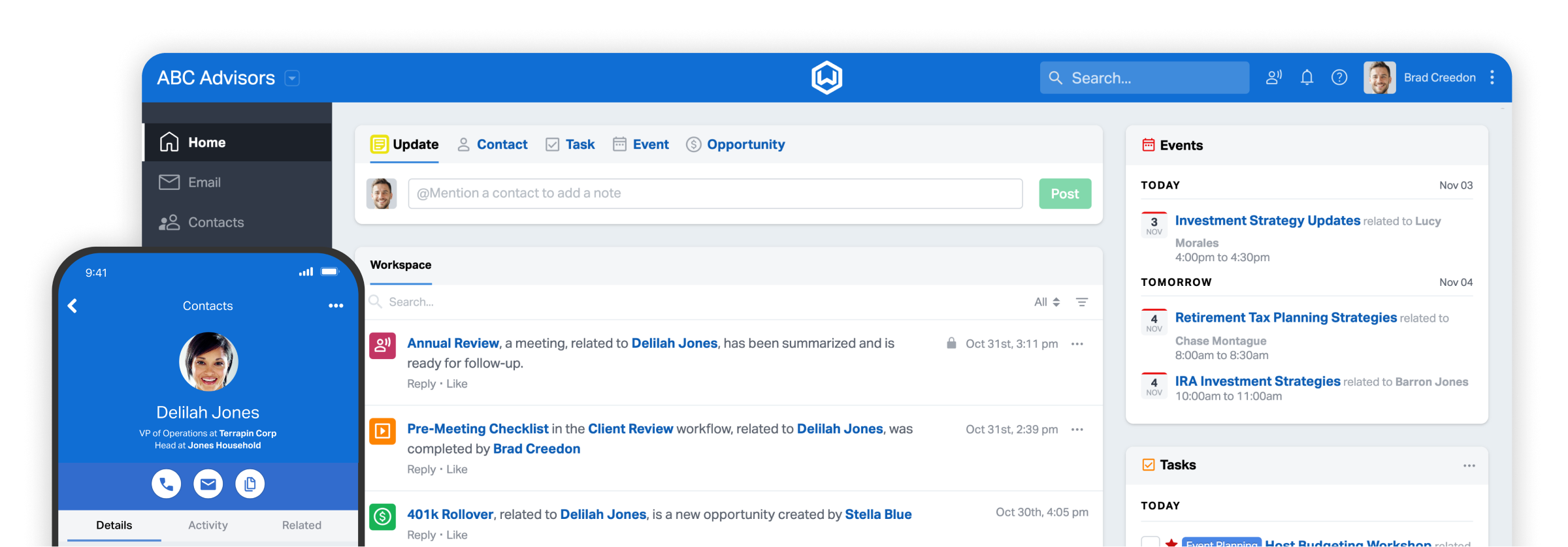

Building Your Distributed Financial Stack

Okay, so challenges identified. Now, what do you actually use? Your tech stack is your lifeline. It needs to be integrated, automated, and accessible.

| Function | Tool Examples & Purpose | Key Consideration |

| Spend Management | Brex, Ramp, Spendesk. Issue virtual cards, set per-diem limits, automate expense reports. | Look for tools that integrate with your accounting software natively. Saves countless hours. |

| Global Payroll & Compliance | Deel, Remote, Oyster. Handle contractors and employees legally across borders. | Don’t try to be an expert in every country’s labor law. That’s their job. |

| Accounting & Bookkeeping | QuickBooks Online, Xero, NetSuite. The core ledger. | Cloud-based is non-negotiable. Your accountant should be able to access it from anywhere, too. |

| Payments & FX | Wise, PayPal, Stripe. Send and receive international payments with fair fees. | Compare FX margins—they add up fast. Automate payments where possible. |

Honestly, the magic isn’t in any one tool. It’s in how they talk to each other. An expense approved in Spendesk should flow into Xero without manual entry. A new hire in Deel should auto-populate in your payroll run. That integration is what gives you back your time—and your sanity.

Crafting Policies That Actually Work for Humans

Policy. It sounds rigid. But for distributed financial management, a clear, humane policy is what enables freedom. You know?

Instead of a 50-page rulebook, focus on principles and guardrails. For instance:

- Define “Reasonable” Clearly: “We trust you to book travel that is safe, reasonable, and gets the job done.” That’s too vague. Try: “For intercontinental flights, book economy class. For flights under 5 hours, premium economy is permitted. Choose centrally-located 3-4 star hotels.” Specificity prevents anxiety and awkward conversations later.

- Implement a “Pre-Approval” Threshold: Any single expense over $500 needs quick Slack approval from a budget owner. Under that? Use your judgment. This balances control with speed.

- Default to Asynchronous Processes: Requiring a physical signature on a PDF is a remote company’s nightmare. Use e-signatures (HelloSign, DocuSign) and approval workflows inside your spend management tool.

The Human Side of Remote Finance

This part often gets overlooked. Finance isn’t just about numbers—it’s about people. And in a remote setting, you have to be intentional about the financial culture.

Transparency Builds Trust: Share high-level budget goals and outcomes with the whole team. When people understand the “why” behind spending limits or investment choices, they’re more likely to be thoughtful stewards. A monthly “Ask Me Anything” with the CFO or head of finance can work wonders.

Onboard Relentlessly: Don’t just email a new hire a link to the expense policy. Record a short Loom video walking through a typical expense report. Make the first submission a guided practice run. This reduces errors and fear.

Celebrate Fiscal Responsibility: Recognize when a team finds a cost-effective solution or comes in under budget. It reinforces that smart financial management is a valued part of the company’s success, not just the finance department’s job.

Looking Ahead: It’s About Agility, Not Just Location

In the end, mastering financial management for a distributed company isn’t a technical problem to solve. It’s a strategic capability to build. The companies that get this right—that pair airtight systems with a culture of trust and transparency—don’t just survive being remote.

They thrive because of it. They can tap global talent, enter new markets with agility, and operate with a resilience that office-bound companies might struggle to match. Their financial engine isn’t a constraint; it’s the fuel for a truly borderless ambition. And that, honestly, is the ultimate competitive edge.